Planning the optometric year ahead

Pre-amble

Why would one want to plan the year ahead as an optometrist?

It provides a target to aim at, which acts as inspiration to the whole team to grow the business year on year. Inflation is a constant threat to everybody’s buying power, employer and employee alike. Effectively, we will all become poorer if we don’t grow our businesses. The budget/forecast serves as an incentive to do better, as well as quantifying from month to month, what we are achieving. The temptation, and for some, the common practice of pulling a thumb suck number out of the air by which we plan to increase revenue, is not the cleverest way to go about planning. It is easy enough to say you are going to increase turnover by 15%, but how in effect, is it going to happen? The Gap Model, proposed here, addresses a methodology, which connects a forecast with a precise action plan in order to achieve the increase in turnover. Moreover, the percentage increase in salaries and rent have outpaced the percentage increase in turnover over the past decade. How do we counter against these events in order to guard against becoming poorer?

Change your financial year-end

It just makes so much sense for an optometrist to have a financial year-end in July instead of February. The optometric trading year is one of two halves. Turnover in the winter can easily be 20% percent down on the summer months. It creates undue pressure to have business plans and marketing plans ready by 1st March, when December and January are the two biggest turnover months, whereas, June and July offer a lot of spare time to devote to budgets and planning. It is not difficult to change. Simply run one financial period for eighteen months.

The Income Statement

The Profit and Loss or Income Statement forms the bases of the budget. We plan for profit, not just turnover and to this end, we need to pay attention to the cost of goods we are going to buy, what our fixed expenses are going to be and then of course, predict how much turnover we are going to make.

Cost of sales

How effectively we buy, meaning, what discounts we get, can have a profound effect on the annual net profit. Two things move the price of goods. How much you buy and how soon can you pay. Planning your purchases carefully around these two issues can have a big impact on your margins. For instance, place a big order in October to see you through the summer. You can bulk it up by forming a buying group with colleagues. Build your cash flow to allow you to do cash buys – this can bear handsome results.

Fixed expenses

These expenses are fairly easy to predict and remain more or less constant throughout the year. Salaries and rent are the main culprits that eat into your personal rewards from the practice. In optometric terms, they have increased more as an expense, than turnover growth over the past ten years. Ten years ago, it would have been possible to contain your salary cost to 16% of turnover and your rent perhaps at 8%. Today, the benchmarks are probably salaries at 22% and rent in the 12% region. This of course, has a direct knock on effect on the net profit. Long service staff tend to put a lot of pressure on the salary bill. One must think in terms of what a job is worth and not what the person is worth. An optometric frontliner cannot earn R20 000 per month. You will always find someone that can perform the job very well for half that price. Long-standing staff roll over with inflation until they earn more than the job is worth. Benchmarks are very useful in this area. One can group these fixed expenses into four categories:

Salaries – 22%

Rent – 12%

Financial leases or loans – depends on the practice

Other expenses -10%

If you don’t meet your benchmarks, it will require strategising and planning to get there. It is worth a mention that benchmarks cannot be taken as absolute across the industry. Each practice will develop its own meaningful benchmarks over time.

Turn over forecast

To do a turnover forecast without a previous year of actual numbers to rely on, is a bit of a lottery. However, with previous records at hand, one would strongly be guided by it. In graph form it becomes easy to spot any trends. The best way to measure growth in an optometric practice is by the number of patients seen in a year and the Gap Model acknowledges the importance of this.

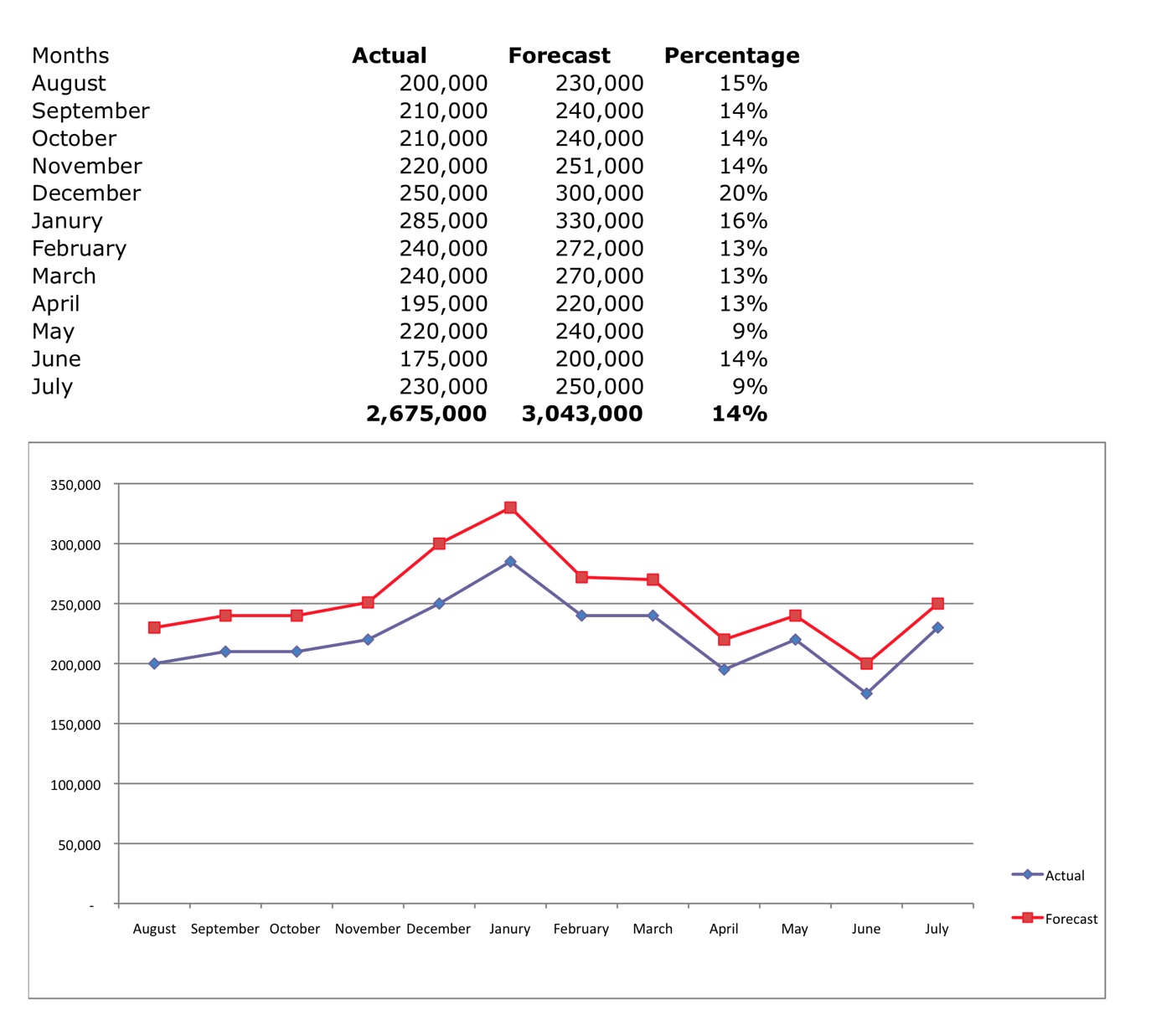

First off, it is important to identify any abnormalities in the previous year’s actual results. This is best illustrated in Graph 1.

Graph 1 presents a hypothetical example. April 2010 was a particularly poor month and likewise was June. On further inspection it was acknowledged (for example), that there were three extra holidays during April and then of course it was FIFA world cup in June. These were extraordinary events and won’t be repeated in the ensuing year. There could be many similar reasons such as absence of key personal due to illness, macro economic issues such as a depression. When Chris Hani was assassinated on the 10th April 1993, retail turnovers took a significant dip. Consequently, we can adjust the expected turnover for these two months accordingly before we apply a 16% overall increase in our forecast.

Graph 1

It can be seen in Graph 1 that April and June yielded much lower than expected turnover. This was due to “abnormal events” which we don’t expect to be repeated in 2011. If we just follow the trend, we will end up forecasting an increase of only 13% and 14% respectively for April and June.

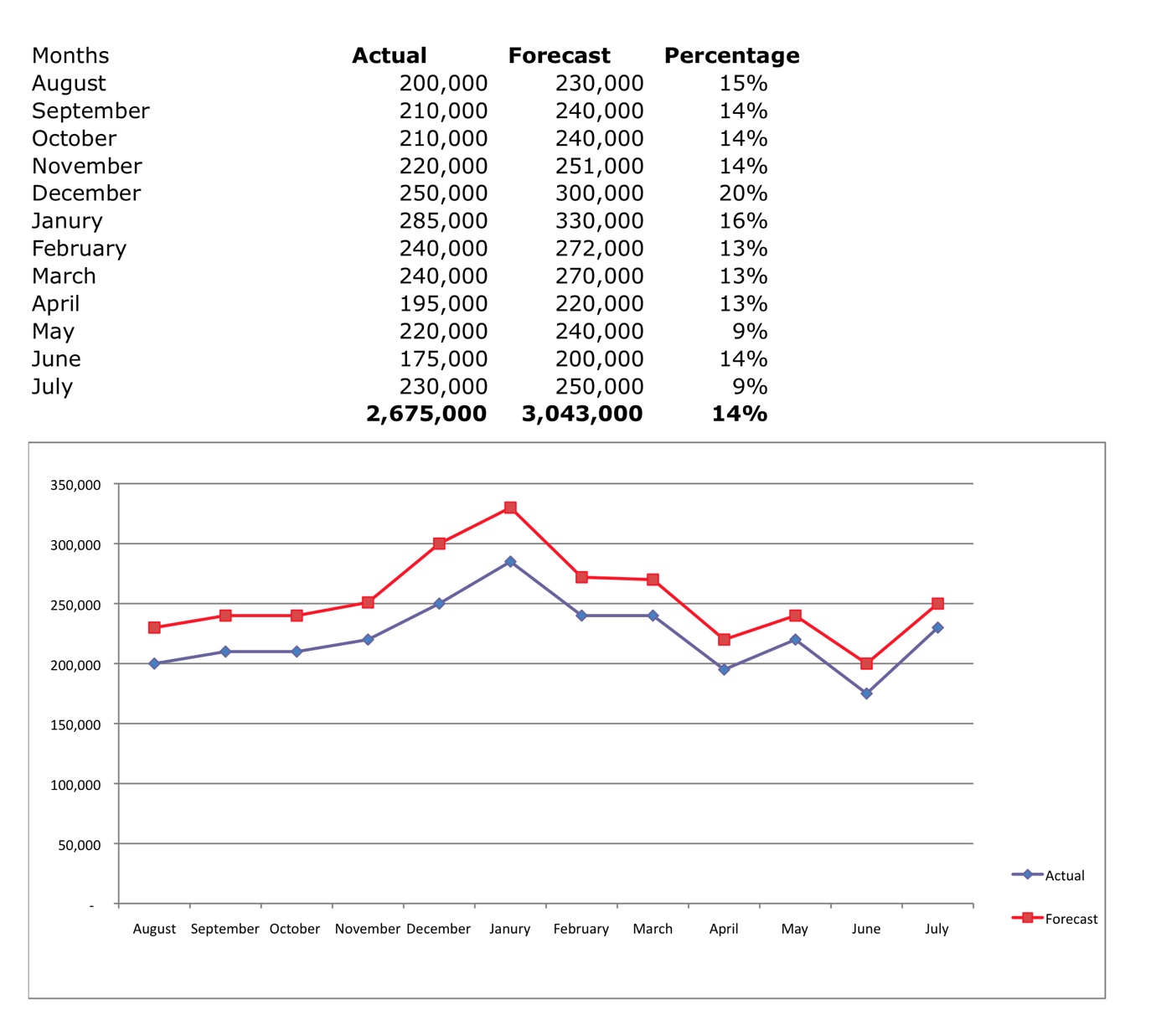

Graph 2

In Graph 2, we have applied a forecast of 28% and a 31% increase in turnover for April and June in order to “normalise” those two months, relative to what can be expected. By doing this, our overall turnover forecast jumped from 14% to 16%. The moral of the story is, start from an “honest” baseline.

The Gap Model

It is easy to fall into the trap of basing the new forecast on some arbitrary “gut feel” percentage.

Applying the Gap Model keeps us honest. It asks of us to defend the Gap in our forecast from one year to the next. In the example below (Graph 2), our Gap is 16% or in Rand value, R343 000 more turn over for 2011. Utilising the Gap Model, we now have to pose the question, “How is this going to happen?”

Applying the Gap Model keeps us honest. It asks of us to defend the Gap in our forecast from one year to the next. In the example below (Graph 2), our Gap is 16% or in Rand value, R343 000 more turn over for 2011. Utilising the Gap Model, we now have to pose the question, “How is this going to happen?”

We must now convert the Rand value into the actual number of patients required and secondly, we have to come up with an action plan, which can support the notion that we are going to see this number of additional patients in the new financial year.

We now have to convert the Rand Value into the number of patients required. This can easily be done if you know your average invoice value.

Average invoice value

This is simply the annual turnover divided by the number of invoices over the year. In other words, the average value of every invoice cut. Let’s say the average invoice is R1 500.

From Graph 2 it can be seen that I need to do R343 000 more for the year. This number divided by R1 500 gives me 228 patients for the year, which comes to 19 additional patients per month. This is less than one patient per day.

Now, our task becomes clearer. Pose the question: “How am I going to attract 19 extra patients per month to support my forecast.” This converts a potential educated guess to a more tangible target, driven by a specific action plan.

The Action Plan

The Gap Model further requires a tangible action plan as to how exactly we are going to get 228 additional patients through the door during the 2011 financial year. The best way to fill The Gap is to base your action plan on your five (or less) best ideas. It is best to focus on just a few, which are likely to give the best return on the effort. Here are some typical projects or strategies that the optometrist may decide to pursue in the quest of pulling in more patients.

Annual leave – consider taking your leave during the lowest turn over month as opposed to, during the summer months.

Data base revamp – set up a team to telephonically update your patient records over a few months. This generates turnover.

Extra refracting lane – beef up your optometric manpower during the peek days and months.

Sustained awareness campaign – make sure that your whole catchment area knows you exist.

SMS campaign – talk to your patients regularly about the right stuff that they are interested in.

Marketing plan – institute a marketing plan with a budget to match and execute it accurately over a predetermined period.

Average invoice – launch a campaign to increase the value of your average invoice by up-selling.

Staff leave – don’t grant leave during the summer months.

Increase prices – inflation spares nobody (between 5-6%). Part of your increased turn over must come from your own price increase.

These are merely examples of the kind of actions, which can fill The Gap. Each individual practice will present its own opportunities.

Example

-

Data base revamp

-

Increase staff compliment for December and January

-

Send out 200 personalised patient re-calls per month

-

Improve frame and contact lens inventories

A plan (a goal) must have the following components:

-

Be specific

-

Attainable

-

Measurable

-

Within a period of time

It is highly advisable that the actions proposed to fill The Gap, obey these rules. Focus on each project and document the action plan in detail. Make sure that the goal is specific, realistic, measurable and set a deadline. Then do it and measure it! The ultimate measure will be the number of additional patients generated each month.

The plan must live

It must be said, if you follow the plan and you fail, you may be excused, but if you fail and you did not follow the plan you should be fired! The moral of the story is, if you take the trouble to file a good business plan, don’t let it end up, forgotten, in some drawer – use it! Your business plan should incorporate the marketing plan, purchasing plan, human resource management, inventory control, the financial forecasts (really the Income Statement) and an extension to all of this, your own personal financial plan. These make up the optometrist’s working tools and should be the collective compass for the new financial year. Whenever a strategy session takes place, even in your own head, your business plan should be on the table.

Conclusion

The Gap Model is a simple yet powerful tool. All it really does is quantify the promise we make to do better in the next financial year. It forces us to be specific about how we are going to grow our business. The nervous system of a practice is the software management package it runs on. If you have the right set up, all practice management issues become easy including planning your next year. Try the Gap Model – I think you will find that you will do better