The importance of understanding Gross Profit Percentage

A sure way to jeopardise a business is to neglect the gross profit. Likewise, the easiest way to improve your business is to enhance the gross profit. In order to manage the gross profit, one must understand the mechanics of the gross profit percentage. Adopting a sound purchasing strategy, which will ensure buying your products at the best price, can do wonders for your bottom line. This is how you can make more profit without seeing more patients.

Mechanics of the gross profit percentage

It is vital to understand the mechanics of the gross profit percentage as a management tool. Firstly, we must distinguish between gross profit and gross profit percentage. Gross profit is simply the difference between the cost we buy our products for, and what we sell them for. The annual net profit before tax, is arrived at by subtracting all our expenses from the gross profit.

The Gross Profit formula looks like this:

Gross profit = Turnover – Purchases or Cost of Sales

Note, in optometry, part of our sales is derived from consultations, which do not have a cost of sales. The cost of consultations is the optometrist’s salary and is recorded as an expense in the income statement. This means, that the amount coming in from consultations will boost your gross profit.

Gross Profit Percentage is the valuable tool we can use to manage the relationship between what we pay for goods and how much profit we ultimately make. Markups will of course differ over different product groups; therefore, it is much more effective to use the GP% as a management tool to monitor the actual gross profit we make across the board. It can be seen as the average percentage of gross profit we make.

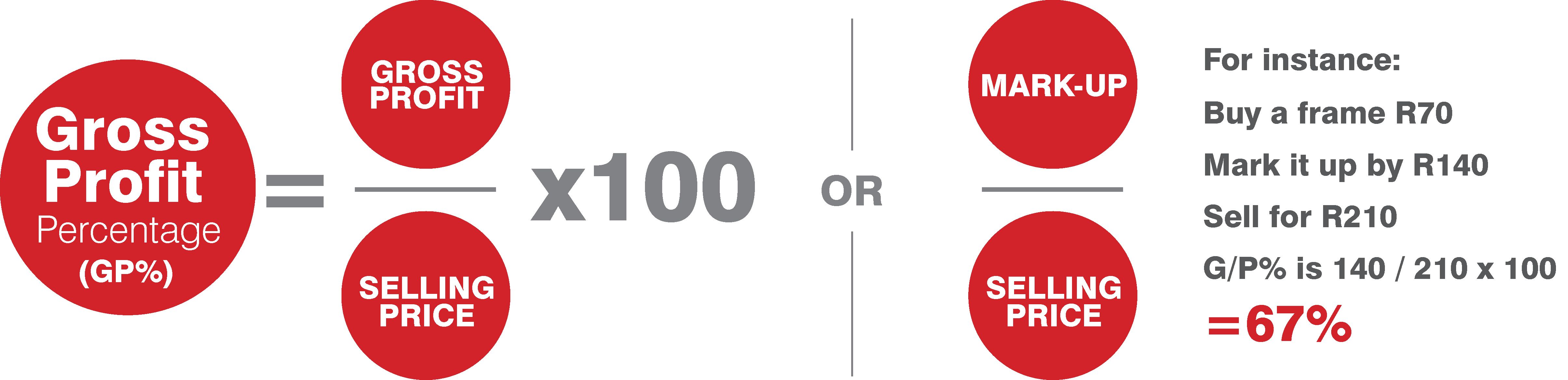

The gross profit percentage formula:

Gross profit percentage (GP%) = gross profit divided by selling price x 100

Or

The mark-up divided by the selling price

Buy a frame for R70 and mark it up by R 140 to sell for R 210

140/210 x 100 = GP 67%.

From a management point of view, we want one number that represents the GP% of all the product we sell.

Note that the GP% is only ever influenced by factors, which can have an influence on the purchase price or selling price of product.

It is not affected by your general expenses such as salaries, rent or telephone bills.

Here are the factors, which could influence the GP%:

-

Purchase price

-

Selling price (mark up)

-

Discounts received – a discount from your supplier obviously reduces the cost price.

-

Discount given – reduces the selling price

-

Shrinkage (stealing effectively results in having to pay more for your goods)

-

Re-makes – using another pair of lenses or frame effectively raises the cost you paid for stock.

-

Stock losses – makes your stock (cost price) more expensive

-

Redundant stock – same as above.

-

Undisclosed income – not declaring all your sales is effectively eroding your sales or selling price. This is obviously done to lighten the tax burden and is illegal. From the SARS point of view, a low GP% will always raise suspicion of undisclosed income.

-

Product mix – selling expensive product with a lower mark-up as opposed to product with a higher mark-up.

-

Consultations – undercharging or not doing enough consultations, relative to the turnover can decrease the GP%.